Filing your VAT through Miragebooks is simple and efficient. Follow these steps to complete your VAT filing with ease:

Step 1: Purchase the Service and Receive Login Information

After purchasing the VAT filing service on the Miragebooks website, the system will automatically send your login details to the email address you provided. Please check your inbox and follow the instructions to log in.

Step 2: Upload Your Tax Invoices

Once logged in to Miragebooks, you need to upload all tax invoices that require VAT filing. There are two ways to upload invoices:

- Bulk PDF Upload: Ideal for users who already have electronic invoices in PDF format. You can upload multiple files at once.

- Photo Upload: If you have paper invoices, use Miragebooks’ built-in photo feature to capture and upload them.

Note: Miragebooks will automatically extract all essential information from your invoices and verify their authenticity, ensuring they are valid for VAT filing.

Step 3: Preparing Invoices for Upload

Before uploading your invoices, make sure they meet the following requirements:

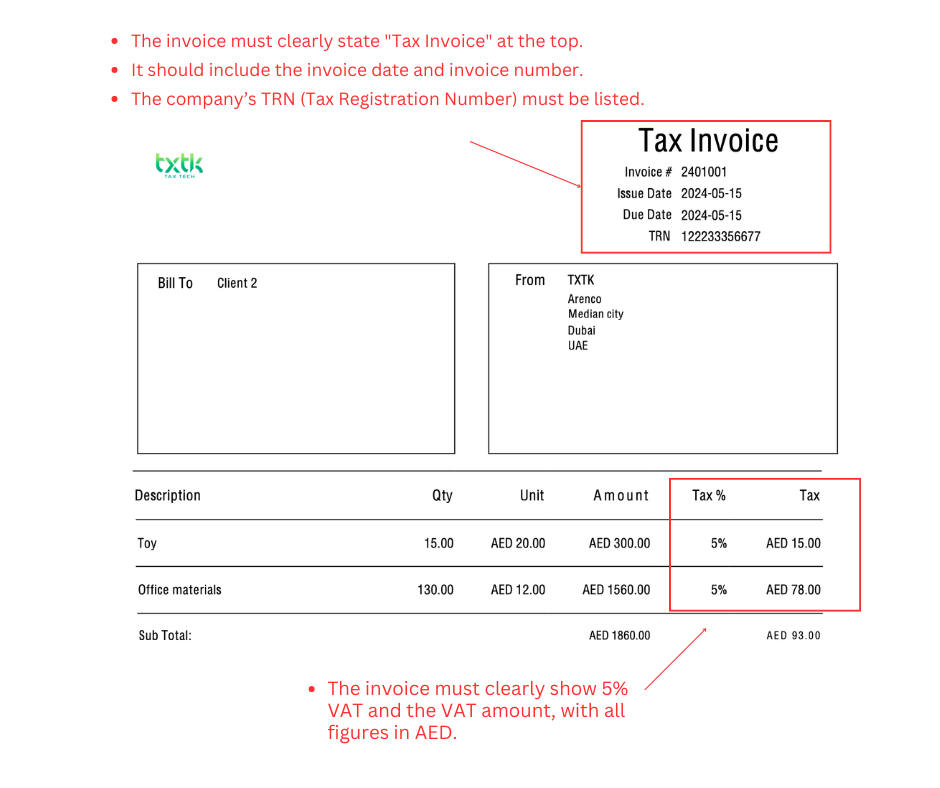

- The invoice must clearly state “Tax Invoice” at the top.

- It should include the invoice date and invoice number.

- The company’s TRN (Tax Registration Number) must be listed.

- The invoice must clearly show 5% VAT and the VAT amount, with all figures in AED.

If the invoices do not meet these criteria, the UAE Federal Tax Authority (FTA) will consider them invalid, and VAT filing will not be possible.

Step 4: Review and Confirm Your VAT Report

Within 10 days after the end of each quarter, Miragebooks will generate your VAT report and send it to your email for review. At this stage, you need to:

- Carefully review all the information in the report.

- If any adjustments are required, contact Miragebooks’ customer service and ensure changes are made by the 20th of the following month.

Step 5: Submit VAT Filing and Pay the Tax

Once you have confirmed the VAT report, Miragebooks will submit your VAT filing to the FTA within 3 days. After submission, you will receive a payment reference number (Reference #) via email. You will need to complete the payment within 24 hours of receiving this number.

By following these straightforward steps, you can easily and efficiently file your VAT!

Miragebooks—Your Professional and Convenient VAT Filing Solution!